The global economy is being rewired by shifting geopolitics, changes in high-tech and renewable supply chains, and lower consumer demand in the U.S. and European Union.

One major consequence of these changes: a slip in trade with China, the world’s top exporter, and number two importer, of goods and commodities.

On Tuesday, China reported total exports for January and February falling 6.8% year-on-year to $506.3 billion, with imports declining 10.2% to $389.4 billion. China’s National Development and Reform Commission (NDRC) Sunday blamed “protectionism, [slower] growth of global trade, and competition in the international market.”

Because the Chinese New Year falls on different dates in the first two months of every year, Beijing combines the first two months in reporting trade data to avoid wild year-on-year swings.

Hampered by inflation and economic malaise, people in the U.S. and EU aren’t buying consumer goods like they used to. Chinese textile exports fell 22.4% to $19.2 billion. Garment exports fell 14.7% to $21.7 billion. Footwear exports declined 11.6% to $8.1 billion. Toy exports fell 10.1% to $5.4 billion. Mobile phone exports increased 2% to $23.7 billion.

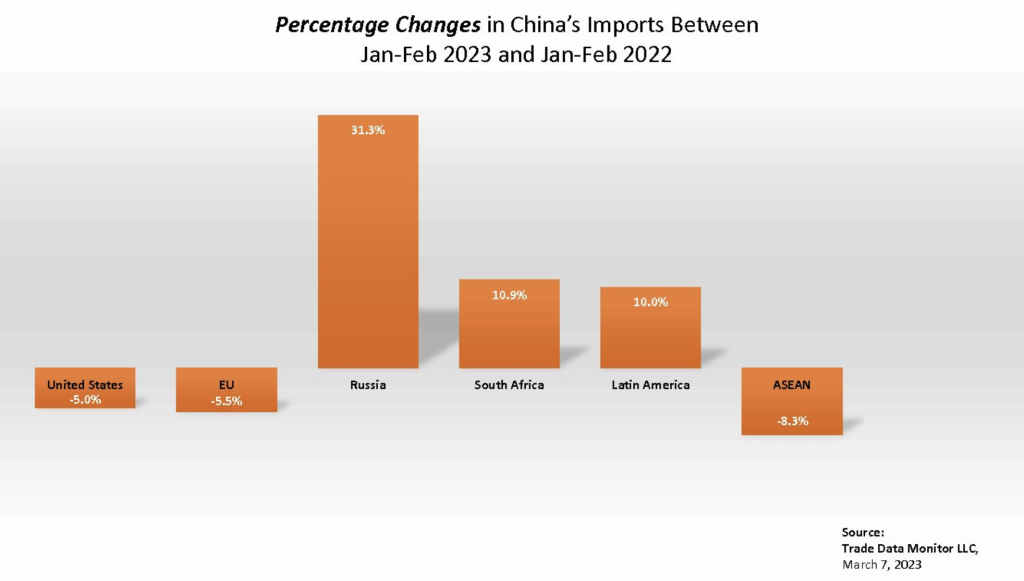

Consequently, exports to the EU fell 12.2% to $80.1 billion while imports declined 5.5% to $43.3 billion, and exports to the U.S. fell 21.8% to $71.6 billion while imports fell 5% to $30.3 billion.

And some in the UK might have thought that Brexit would help London cement new trading relationships with economies outside the EU. That’s not a dream come true. Exports to the UK fell 14.4% to $11.2 billion, while imports declined 11.7% to $3.6 billion.

Taiwan is the world’s biggest manufacturer of semiconductors, but in the recent tension over these key ingredients in computers and phones, the country is siding with the U.S. Chinese exports to Taiwan fell 18.1% to $10 billion, while imports declined 30.9% to $27.5 billion. Imports of integrated circuits fell 25.9% to $47.8 billion.

At the same time, China is cementing closer relationships with new allies. Most prominently, that’s Russia. Exports to Russia rose 19.8% to $15 billion while imports soared 31.3% to $18.6 billion. “The China-Russia relation is based on no alliance, and no confrontation, and it is not targeted at any third party, it is not a threat to any country, nor it is subject to any interference or discord sung by a third country,” said foreign minister Qin Gang.

But it’s also South Africa, which recently joined military exercises with Russia and China. Chinese exports to South Africa rose 14.5% to $3.9 billion, while imports from the resource-rich nation increased 10.9% to $5.5 billion.

And it’s also, in part, Latin America, from which imports rose 10% to $37.6 billion, although exports fell 8.3% to $34.4 billion. In the new renewable-based economy, China is relying on Latin America for key commodities, especially copper and lithium, an ingredient in making the batteries essential for replacing fossil fuel. The so-called lithium triangle wraps in Bolivia, Argentina and Chile, and Chinese companies have been investing in mining and production in those countries.

There is another sector where Latin America is strong and where China is becoming a better import market: agriculture. Meat imports increased 21.6% to $4.9 billion. Grain imports rose 21% to $15 billion. Soybean imports increased 28.3% to $10.8 billion. There were increases in imports by volume for all three of those commodities.

China also hiked imports in key industrial commodities. Coal imports soared 70.8% to 60.6 million tons. By value, they increased 39.4% to $8.3 billion. Imports of copper ore and concentrates, which are crucial to high-tech production, rose 11.7% to 4.6 million tons. By value, those imports fell 5.3% because of price declines.

Imports of automobiles declined 25.5% to $7 billion. Automobile exports, however, soared 65.2% to $14 billion, as China’s car industry continues to develop new exports markets. And exports of another industrial good, fertilizers, increased 29.6% to $1.4 billion.